Why do financial accounting concepts make sense when we hear them in class, but the sense of accounting seems to get lost when we apply the same accounting concepts at home. I know I experienced this when learning accounting concepts. As I wrote down each step in an accounting process on paper along with the… Continue reading Why Accounting Makes Sense In Class But Not At Home

Tag: Accounting Help

Why Accounting Makes Sense In Class But Not At Home

Why do financial accounting concepts make sense when we hear them in class, but the sense of accounting seems to get lost when we apply the same accounting concepts at home. I know I experienced this when learning accounting concepts. As I wrote down each step in an accounting process on paper along with the… Continue reading Why Accounting Makes Sense In Class But Not At Home

Metric of the Month: Hurricane-Proof Accounts Receivable

Metric of the Month: Hurricane-Proof Accounts Receivable – https://t.co/qJtpCmAAAT – https://t.co/Wfw6iBXuzy pic.twitter.com/pmQ2o0baYB — CFO (@cfo) October 9, 2017 https://lnkd.in/gSaubmv http://bobsteelecpa.com/ https://lnkd.in/gfA5nTx https://lnkd.in/g_hrnAA

Is the State and Local Tax Deduction in Place to Protect Against Double Taxation?

Is the State and Local Tax Deduction in Place to Protect Against Double Taxation? https://lnkd.in/gSaubmv http://bobsteelecpa.com/ https://lnkd.in/gfA5nTx https://lnkd.in/g_hrnAA

Accounting Comic

Accounting Comic https://lnkd.in/gSaubmv http://bobsteelecpa.com/ https://lnkd.in/gfA5nTx https://lnkd.in/g_hrnAA

House/Senate compromise could be a win-win for taxpayers

TTARA: What to expect from #txlege #property #tax #reform during special session. https://t.co/nBgtGfXZwj — TTARA (@txtaxpayers) July 6, 2017 https://lnkd.in/gSaubmv https://lnkd.in/gny4NxK https://lnkd.in/g3BY2N9 https://lnkd.in/e77p7eB

How the PTIN Issue at the IRS Affects Tax Professionals

How the PTIN Issue at the #IRS Affects #Tax Professionals https://t.co/lND31FjK75 @CRUSHTheCPAExam pic.twitter.com/fvs9HIkNGl — AccountingWEB (@AccountingWEB) July 2, 2017 https://lnkd.in/gSaubmv https://lnkd.in/gny4NxK https://lnkd.in/g3BY2N9 https://lnkd.in/e77p7eB

Accounting Comic

https://lnkd.in/gSaubmv https://lnkd.in/gny4NxK https://lnkd.in/g3BY2N9 https://lnkd.in/e77p7eB

Accounting Book #200

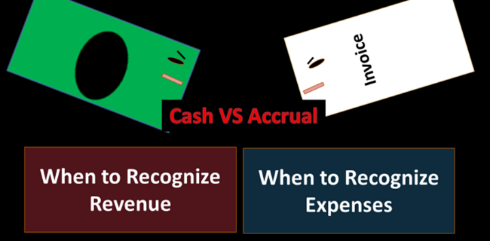

Cash Basis VS. Accrual Basis – The Epic Battle?

The accrual basis can be compared and contrasted to a cash basis, the cash basis being a simplified method, one which does not provide information as useful, as relevant, or as accurate as an accrual method. What We Need to Know About Cash Basis Cash basis Records revenue when cash is received and expenses when cash… Continue reading Cash Basis VS. Accrual Basis – The Epic Battle?