Three Ways to Represent the Double Entry Accounting System – Need To Know

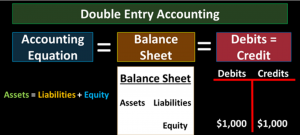

There are many ways the double entry accounting system can be expressed including the use of an accounting equation, debits and credits, and a balance sheet.

Double Entry Accounting System Explained Using The Accounting Equation

We will focus on the accounting equations in this article. The benefits of an accounting equation include the use of a simple formula, simple math that can be explained and understood. Transactions can be described using the symmetry of the accounting equation. The problem with using the accounting equation to record transactions and build the financial statements is that it is not as efficient as the use of debits and credits. We will learn the balancing concept using the accounting equation, but as we do, keep in mind that the accounting equation is not the whole story, that we will need to understand new concepts, the concepts of debits and credits, to record data with which to generate financial statements well.

Most Useful Formats to Represent the Accounting Equation

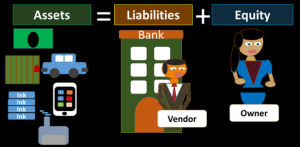

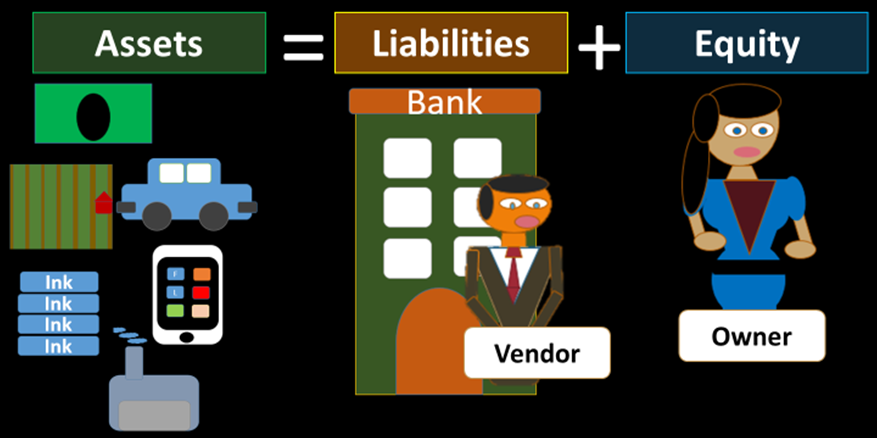

Asset = Liabilities + Equity

The format above is the most common form of the accounting equation for financial accounting because the left side of the equation shows what the business owns and the right side shows who it is owed to, either a third-party liability or the owner. Recall our separate business entity assumption, discussed in a prior post, (http://bobsteelecpa.com/?p=813) while considering the accounting equation. Thinking of the business as a separate entity helps to understand the accounting equation, the left side of the equal sign showing what the separate entity owns, the right showing who has claim to what the separate entity owns.

Because the accounting equation is a formula it can be expressed at least two other ways. A second way to write the equation is:

Assets – Liabilities = Equity

The format of the accounting equation above is useful because it emphasizes that equity is the book value of the company, the amount left over after subtracting liabilities from assets, an amount which can also be called net assets. To understand the meaning of equity we can consider the liquidation of a company, the selling of assets for cash, the payment of liabilities owed, and the left-over cash which would then be available to the owner, this amount being equal to equity if assets were sold at book value. Note that all assets will not be sold for the exact amount reported when a business is sold. For example, an asset of equipment valued at $50,000 may not be sold for $50,000 in a free market, possibly being sold for something less like $40,000 or something more like $60,000. We will discuss this more at a later time. For now, remember that equity represents net assets on a book value basis, assets minus liabilities.

A third way to write the accounting equation is:

Assets – Equity = Liabilities

This format of the accounting equation is not as useful but is another way the accounting equation can be expressed algebraically.

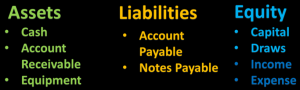

Why We Need to Know Account Types

Account types include assets, liabilities, equity, revenue, and expenses. Recognize that account types are not the same thing as actual accounts, each account type having multiple accounts falling into the category. Understanding account types and the accounts that fall into each account type category is essential to the accounting process.

Assets Definition and Examples

Assets are resources owned by the business. The most common asset is cash, but assets also include accounts receivable, prepayments, land, building, and equipment. Assets are items that have not yet been consumed, resources planned to be used in the future to achieve business goals, to help generate revenue.

Liabilities Definition and Examples

Liabilities are claims by creditors. Liabilities come about from a transaction that happens in the past which obligates the company for some form of future payment. Purchasing something on a credit card is an example of how a liability can be created, the transaction creating a future obligation to pay cash. Liability accounts include accounts payable, notes payable, and bonds payable.

Equity Definition and Examples

Equity is the owner’s claim to assets. Equity is equal to assets minus liabilities. Equity is often the most confusing section of the accounting equation, in part, because different organization types will organize the equity section differently and because the equity section is involved in the closing process of temporary accounts.

The equity section represents what is owed to the owner on a book basis. This is best illustrated by imagining we liquidate or close a business, selling the assets for cash, and then paying off the liabilities. The money left over would be equal to the equity section if all sales were made on a book value basis.

The equity section for a sole proprietor will be called owners’ equity and consist of one capital account. The equity section of a partnership will be called partnership equity and consist of two or more owners and therefore two or more capital accounts. The equity section of a corporation will be called shareholder’s equity, shareholders being the owners of a corporation, and will included capital stock and retained earnings. Although the format changes the equity section taken as a whole can still be thought of as what is owed to the owner or owners in each case.

When thinking about the accounting equation, the equity section includes all temporary accounts, including revenue accounts and expense accounts.

Revenue Definition and Examples

Revenue – is income generated from performing work. Revenue is not the same thing as cash. Cash is a form of payment while revenue represents the creation of value and the earning of compensation. Revenue is a timing account, needing to be measured over a time frame, a starting and ending point. For example, when somebody says they earn $100,000 the concept has no meaning unless we assign a time frame, most people naturally attributing a year as the time frame when hearing a number like $100,000. A different time frame would have a much different meaning. For example, revenue of $100,000 a month is much different than revenue of $100,000 a year.

We can contrast temporary accounts, like revenue and expense accounts, with permanent accounts like cash. Saying we have $100,000 cash does not require a time frame to define what we mean because cash is a permanent account, representing a position at a point in time.

Expense Definition and Examples

Expense is the using of assets or incursion of liabilities as part of operations to generate revenue. Expenses are what a business needs to consume to achieve the goal of revenue generation. Expenses are also temporary accounts needing a beginning and ending time.

There are usually many more expense accounts then revenue accounts, but we hope the revenue accounts add up to a greater dollar amount. The reason there are more expense accounts then revenue accounts is because of specialization, companies focusing on earning money by doing what they do best and paying for their other needs.

Obstacles to Learning Accounting are the Same as Those for Learning Music

http://www.youtube.com/c/AccountingInstructionHelpHowToBobSteele

http://accountinginstruction.com/

https://www.linkedin.com/company-beta/18090288/

1 comment