Ethics plays a huge role in accounting as it does in most professions, in part, because ethics deals with trust and trust is an essential component of any business transaction. The concept of ethics is very broad, has been studied intensely since ancient times, and is an area which still has many open questions, but ethics related to accounting can be narrowed from the broader discussion in some ways.

How to Think About Ethics Related to a Profession

One way to think of ethics as it relates to a profession is by implementing a kind of categorical imperative, acting in a way that we would wish to be universal for the entire profession. For example, stealing could benefit an individual but if everyone steals everyone is worse off and therefore stealing would be wrong.

Similarly, acting in a way that is misleading could lead to gains for an individual but doing so harms the profession and is therefore wrong. Most professions can apply a concept like this, two of the oldest professions being law and medicine. The reason professions are needed in areas like law, medicine, and accounting is because they deal with specialized knowledge, knowledge most people do not have and that many are dependent on at some point in their lives. An uneven distribution of knowledge can cause incentives for individuals to seek short term gains through deceit.

For example, somebody claiming to know medicine could administer medicine that is not effective and the patient would not know, a patient having no choice but to trust the expertise of the doctor. If a physician abuses trust by administering remedies that are not effective, they are profiting off the name of the profession, from the brand of the occupation, and if this practice is done enough, it will result in a lack of trust in medicine.

A similar scenario can be painted for many areas of accounting, accounting having advanced to a specialized field, one that most do not understand, but are forced to deal in at some point or another. The need for trust drives and incentivizes a profession to self-regulate, to build a brand. One way the accounting profession self-regulates is by requiring different certifications to practice in different areas, certifications like a certified public accountant CPA license. A certification process helps provide the public with a level of trust that an individual has some basic understanding of concepts they are dealing with and provides ethical standards that must be met.

Why Ethics is Important to Investors & Therefore Businesses

An example of the need for trust in accounting is when investors use financial statements to make investment decisions. Publicly traded stocks have an increased need for transparency in their financial reporting because their stock is being sold and traded by the public, a huge benefit to both companies and investors, providing capital to companies, and opportunities for gain to investors.

For an individual to invest, however, they need to analyze their options, and financial statements are the primary tool for this analysis. If investors do not have confidence in the numbers reported on the financial statements, do not understand how the numbers are reported, or cannot compare the numbers to related company’s investment transactions will decline due to a lack of information and trust.

The economy needs trust in the system as a major component which keeps interactions taking place, compelling people to take calculated risks, driving individuals to do business and drive growth and innovation.

Fraud – What is it?

Fraud is one component in the discussion of ethics, fraud being the deliberate attempt to deceive for personal gain. Fraud can take many forms in business from theft to falsifying the financial statements to drive up stock prices and increase bonus pay.

Fraud is one component in the discussion of ethics, fraud being the deliberate attempt to deceive for personal gain. Fraud can take many forms in business from theft to falsifying the financial statements to drive up stock prices and increase bonus pay.

How to Reduce Fraud in an Organization

Most people believe fraud is all about employing the right people, honest people, those with integrity. While the right people is a huge component, it is not the only one. Good people in a bad environment or culture can fall victim to the group mentality. Businesses can reduce the likelihood of fraud by recognizing conditions that foster fraud and taking active steps in reducing them.

Fraud Factors We Need to Know

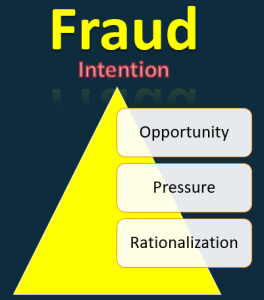

A criminologist has introduced the idea of a fraud triangle, consisting of three factors which increase the likelihood of fraud. Fraud factors include opportunity, pressure, and rationalization.

Opportunity means that the ability to commit fraud and not be caught is present, or at least perceived. For example, if a company had a policy of keeping their petty cash fund in a shoe box in the middle of the lunch room the opportunity for theft without detection would be greater than if the money was put into a more secure location.

Pressure or incentive means that a person is under pressure of some kind, often financial. If money if tight the likelihood of an individual committing fraud is significantly increased.

Rationalization is when a person justifies an action. Our minds are excellent at rationalizing. We generally believe that we think before acting, but we often act and then justify the action through rationalization, one reason fraud tends to continue, and even escalate over time, is that our minds continue to rationalize.

For example, if a company left the petty cash in the lunch room an employee may rationalize theft by reasoning that it’s the companies fault for not better safeguarding their assets. While it may be true that leaving cash in the middle of the lunch room is not a good internal control for a company, it is not a justification for theft. Another common rationalization is that a company is vast and rich while an employee may feel small and poor and taking to from the rich to give to the poor is not bad. Again, there may be some truth to this statement, but it is not a reason justifying theft.

Companies can reduce the likelihood of fraud by recognizing these fraud factors and taking active steps to reduce them, steps including internal controls. For example, companies should safeguard assets and should create a culture of honesty, communication, and respect, a culture that needs to be demonstrated from the top down. If the culture is bad at the top good employees will not be able to pull up the culture from the bottom.

Companies can reduce the likelihood of fraud by recognizing these fraud factors and taking active steps to reduce them, steps including internal controls. For example, companies should safeguard assets and should create a culture of honesty, communication, and respect, a culture that needs to be demonstrated from the top down. If the culture is bad at the top good employees will not be able to pull up the culture from the bottom.

Obstacles to Learning Accounting are the Same as Those for Learning Music

Categories of Accounting – Financial Accounting & Managerial Accounting

http://www.youtube.com/c/AccountingInstructionHelpHowToBobSteele

http://accountinginstruction.com/

https://www.facebook.com/pg/AccountingInstructionhelp/videos/?ref=page_internal

3 comments